Do I need to file a tax return? (2024)

The 2024 tax season is around the corner!

The South African Revenue Service (SARS) has released the tax filing dates for 2024, however, have also specified some taxpayers who would not have to submit a tax return.

2024 Tax filing dates:

Taxpayers exempt from 2024 tax return submissions:

A complex, technical list of criteria is used to determine who needs to file tax returns and who does not. The intricacy of SARS requirements increases with the introduction of tax-specific terms like remuneration, tax-exempt dividends, and tax directives. It also becomes more complicated when factors like travel allowances, fringe benefits, and other benefits are included as part of income.

So, the question remains, DO YOU NEED TO SUBMIT A RETURN?

SARS has issued an online tool to assist taxpayers with making this determination. This tool allows taxpayers to answer some simple questions and determine whether they should file a tax return or not.

This tool can be found at the following link: Not sure whether you must submit an Income Tax Return (ITR12)?

How to use the SARS tool?

Visit the link above

Start by answering the questions as prompted:

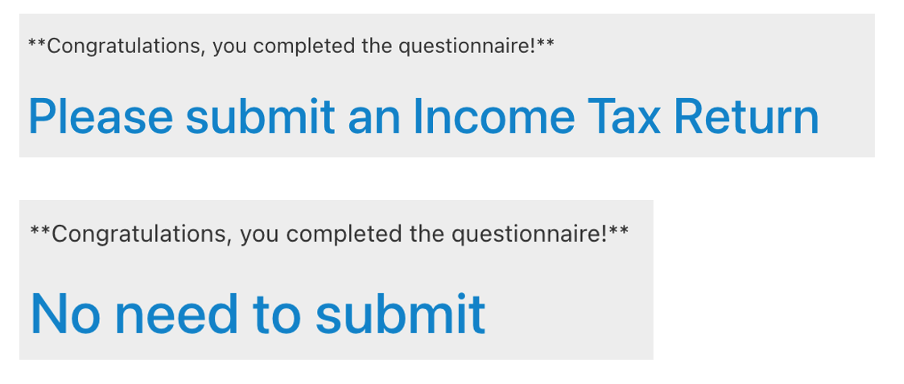

Continue to answer the questions until you receive either of the following outcomes:

Eqeight’s view:

The above is an initiative by SARS to ensure both compliance with tax laws and reduce their administrative load through ensuring that they only receive returns where absolutely necessary. Therefore, driving efficiency in the returns that do get delivered. Moreover, SARS has implemented technology for auto-assessing taxpayers with straightforward tax profiles, eliminating the need for manual filing. This technological advancement has led SARS to permit certain taxpayers to forego filing returns.

Not filing a return however opens up the taxpayer to various risks and could lead to non-compliance with the consequence of fines and penalties. Our view is therefore to continue to file returns, even if at Rnil, to ensure you keep a healthy track record of continuous compliance.

Below are our top reasons for filing your return:

SARS might not agree with your assessment.

As mentioned before, this process and determining whether you should submit or not can be open to interpretation. SARS might imply that you completed some of the questions in their tool incorrectly and argue that you should have submitted a return. This could also lead to fines and penalties.Maintaining a comprehensive tax record works to your advantage.

Consistently filing your taxes leaves no room for SARS officials to suspect any information has been hidden from them. Submitting a tax return showcases your commitment as a responsible citizen.You may forfeit your refund.

We all love a good tax refund! Refunds originate when you've paid more taxes than required throughout the year and are typically highlighted when completing your final tax return at the end of the tax period, once all relevant information is available. You can only get a refund if you file a return.Tax compliance status is important

inancial institutions, including banks, consider your tax compliance status during the financing process. Not filing a return might lead to you not receiving finance for your personal, home or car loans.Retirement fund complications

Tax compliance is necessary to withdraw money from your retirement savings. Consistently filing your tax return each year ensures that if you ever receive a payout from a fund, you won't encounter any difficulties in accessing the money.Peace of mind

Filing tax returns accurately and on time provides peace of mind, knowing that you've fulfilled your legal obligations and minimized the risk of potential issues with tax authorities.

Lastly, we recommend that you involve tax experts or SARS in your decision to file a tax return. As registered tax practitioners, Eqeight Accounting can assist you with all your tax needs.